The Legacy of John Wanamaker: How Whole Life Insurance Built a Philadelphia Retail Empire

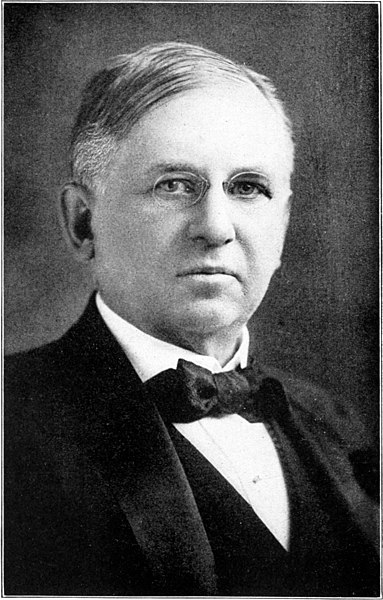

Editor Mary Griffin Webb and Edna Lenore Webb, Public domain, via Wikimedia Commons

Editor Mary Griffin Webb and Edna Lenore Webb, Public domain, via Wikimedia Commons

John Wanamaker set the standard for retail excellence in the late 19th and early 20th centuries. While his vision and business acumen were important to his success, there’s another overlooked factor that helped him.

Life insurance.

Wanamaker’s enthusiasm for life insurance was endless. During his lifetime, he purchased 62 different whole life policies, funding them with substantial premium dollars.

He believed in life insurance so much, he even became a trustee of the Mutual Life Insurance Company of New York.

And to the members of the National Association of Life Insurance Underwriters holding its convention at that time he stated his reasons for taking out these whole life policies:

“I simply worked out five conclusions as the result of my own thinking, without any moving cause except my own judgment.

“First: that at the time I knew I was insurable and I could not be sure of immunity from accident or ill-health and it might be that at some future time I would not be insurable. This was the first step to the building up of my 62 policies.

“Second: that life insurance was one of the best forms of investment because from the moment it was made it was good for all it cost and carried with it a guarantee and there was protection in that investment that I could not get in any other.

“Third: that life insurance in the long run was a saving fund that not only saved but took care of my deposits and gave the opportunity for the possible profits that not infrequently returned principal and interest and profit.

“Fourth: that life insurance, regarded from the standpoint of quick determination, was more profitable than any other investment I could make.

“Fifth: that it enabled a man to give away all he wished during his lifetime and still make such an estate as he cared to leave.

Born in 1838, he started his career as a clerk in a clothing store. By the age of 27, he had saved enough to open his own men’s clothing store. However, it was his decision to embrace the concept of self-financing his own business activities, and specifically using whole life insurance that would separate him from many of his peers.

The Power of Whole Life Insurance

Whole life insurance, a type of permanent life insurance, provides coverage for the entire lifetime of the insured. It accumulates cash value over time, which can be borrowed against or (in some cases) withdrawn. Wanamaker recognized the unique advantages of whole life insurance and leveraged it strategically to secure the financial future of his business and his family.

1. Stability and Security

In the volatile world of retail, where economic downturns and unexpected challenges are par for the course, Wanamaker used whole life insurance to provide a stable financial foundation for his family. By diligently paying premiums and allowing the cash value to grow, he ensured that his loved ones would be financially protected in case of his untimely death. This peace of mind allowed him to focus on growing his business without the constant worry of what might happen to his family’s financial future. He also used his policies to provide financial security for his business, and act as a hedge against uncertainty.

2. Capital To Build

Wanamaker disliked the idea of becoming entangled with Wall Street, disliked the idea of issuing bonds, or going to a bank for a loan.

So, as much as he could, he self-financed everything. And a large part of his self-financing came from his whole life policies.

In Wanamaker’s words:

“I did not know what life insurance really meant to me until my policies were falling due—and I had a large sum of money with which I began to build my Philadelphia Store. I would not have been prepared to start my building when I did if I had not saved $2,500,000 little by little.”

Source: The Business Biography Of John Wanamaker, Founder And Builder, by Joseph H. Appel.

3. Credit To Expand His Business

Wanamaker believed that, “Life insurance assures confidence; confidence begets credit; and credit makes profit.”

Not only did he use life insurance to start his business, he used it to grow and expand it.

Legacy and Impact

John Wanamaker’s use of whole life insurance wasn’t just a personal financial strategy; it was a cornerstone of his business philosophy. His financial prudence, combined with his unwavering commitment to excellence in retail, helped him build a lasting legacy. Wanamaker’s became more than just a store; it was a beloved institution in Philadelphia, known for its exceptional customer service and innovative marketing techniques.

Wanamaker’s is also remembered for its iconic Grand Court with the Wanamaker Organ, which still exists today as part of Macy’s Center City. Wanamaker’s commitment to philanthropy extended beyond retail, with notable contributions to education and social causes. His ability to use the financial stability provided by whole life insurance to fuel his entrepreneurial spirit had a profound impact on the city of Philadelphia and the retail industry as a whole.

Lessons for Today’s Entrepreneurs

While John Wanamaker’s era was vastly different from our own, his approach to whole life insurance holds valuable lessons for today’s entrepreneurs and business leaders:

1. Long-Term Vision

Whole life insurance encourages long-term thinking. It’s not a quick-fix financial solution but a tool for building financial stability over a lifetime. Entrepreneurs can benefit from adopting a similarly patient and forward-looking approach to their businesses.

2. Financial Resilience

The unpredictable nature of business demands financial resilience. Whole life insurance can serve as a safety net, allowing business owners to weather economic storms and focus on growth rather than financial worries.

3. Legacy Building

Whole life insurance can play a role in building a lasting legacy, both personally and professionally. It provides the financial security needed to pursue ambitious goals and make a positive impact on the community.

Wanamaker died with a fortune worth over $100 million (worth several billion dollars today).

His story is a testament to the power of strategic financial planning. While his legacy lives on in the retail world, his use of whole life insurance serves as a reminder that the right financial tools can help entrepreneurs achieve their dreams, secure their family’s future, and leave a lasting mark on the world. In an ever-changing business landscape, Wanamaker’s timeless wisdom continues to inspire and guide those who seek to build their own entrepreneurial empires.

David has been a licensed life insurance agent since 2004. In addition to life insurance design and sales, he has also helped develop educational and marketing content for large financial firms like Allstate, New York Life, State Farm, AmTrust, and J.G. Wentworth. His articles and essays on life insurance and Human Life Value are currently taught at California State University (CSU) as part of its Expository Writing and Reading Course, and his articles on budgeting, life insurance, investing, and financial planning have been featured in online publications like ThinkAdvisor, The Huffington Post, NuWire Investor, and RealClearMarkets. David is also the author of several short eBooks on budgeting and saving money, and the designer of the xFlow™ budgeting app and the xCalc™ suite of financial calculators.

Visit www.monegenix.com to learn more.

SaaS and Technology Agreement Attorneys in New York City

SaaS and Technology Agreement Attorneys in New York City  Real-Life Succession Planning Failures … and How To Avoid Them

Real-Life Succession Planning Failures … and How To Avoid Them  Smart Strategies To Increase the Value of Your Business Before Selling

Smart Strategies To Increase the Value of Your Business Before Selling  The SEC’s New Crypto Task Force: A Step Toward Clarity and Collaboration

The SEC’s New Crypto Task Force: A Step Toward Clarity and Collaboration  Marketing for Introverts: Authentic Strategies That Actually Work

Marketing for Introverts: Authentic Strategies That Actually Work  A Real Shift in Nutrition Policy — And Why It Gives Me Hope

A Real Shift in Nutrition Policy — And Why It Gives Me Hope  Move That Body

Move That Body