Home Sale Prices Continue to Drop

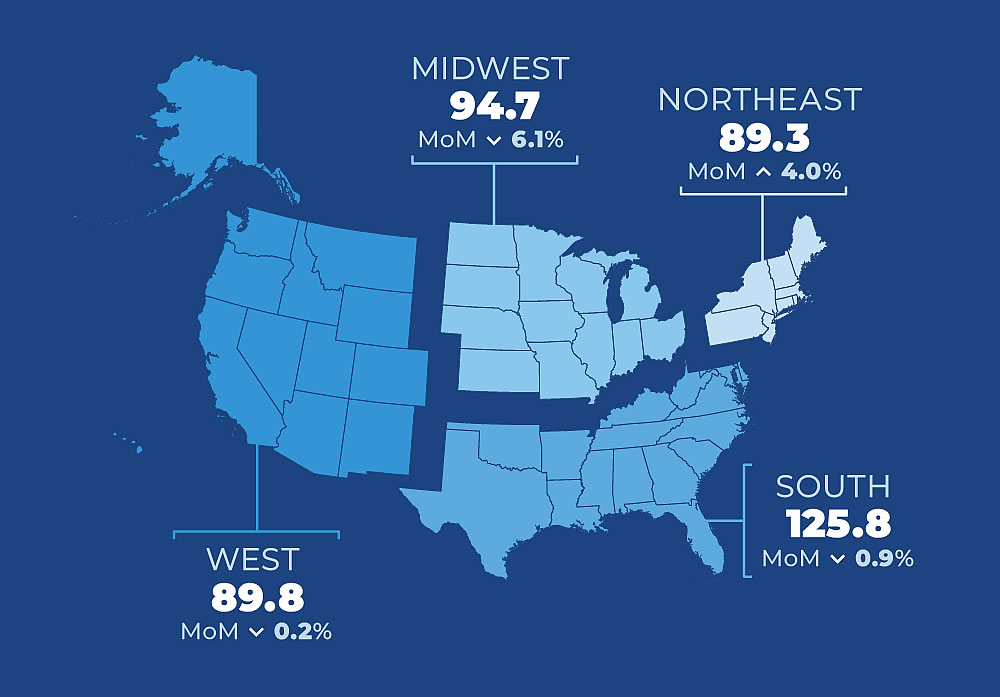

Despite Federal Reserve efforts to cool demand, home sales in the US continue to drop. The National Association of Realtors reported home sales declined by 1.5% in September. The slowdown could lead to homes being sold for less and prices falling.

The Federal Reserve raised its short-term benchmark funds rate three quarters of a point in September. This increase has boosted mortgage rates to record highs. These rates are causing prospective buyers to stay away from once-hot housing markets. They are also keeping homesellers on the sidelines.

Sales fell in nine of the top 10 housing markets. However, New York was the only exception. The declines ranged from 10% in Phoenix to over 20% in Houston.

Sales of new single-family homes fell 17.6% in September. Fannie Mae has revised down its estimate for the year’s total home sales to 5.71 million units. The housing finance agency had previously predicted 5.78 million units.

The median price of an existing home sold rose 8.4% in September. However, prices declined faster at the bottom end of the market. The median price of a home between $750,000 and $1 million fell 9.5%.

The number of distressed sales, including short sales, increased from 1% in August to 2% in September. First-time buyers accounted for 29% of all purchases. Individual investors accounted for 15% of all cash sales.

The Fed’s effort to fight rampant inflation has led to higher mortgage rates. The average 30-year fixed rate mortgage rose to 6.94% this week. However, mortgage affordability continues to decline because home prices remain stubbornly high. The rise in mortgage rates is causing prospective buyers to stay away from homes and renters to delay buying.

For more great business content see our business section.

Also, check out our business media partners — Daily Business Journal and PriceofBusiness.com.

What Mistakes or Pitfalls Could I Have Helped Myself Avoid?

What Mistakes or Pitfalls Could I Have Helped Myself Avoid?  SaaS and Technology Agreement Attorneys in New York City

SaaS and Technology Agreement Attorneys in New York City  Real-Life Succession Planning Failures … and How To Avoid Them

Real-Life Succession Planning Failures … and How To Avoid Them  Smart Strategies To Increase the Value of Your Business Before Selling

Smart Strategies To Increase the Value of Your Business Before Selling  The SEC’s New Crypto Task Force: A Step Toward Clarity and Collaboration

The SEC’s New Crypto Task Force: A Step Toward Clarity and Collaboration  Marketing for Introverts: Authentic Strategies That Actually Work

Marketing for Introverts: Authentic Strategies That Actually Work  A Real Shift in Nutrition Policy — And Why It Gives Me Hope

A Real Shift in Nutrition Policy — And Why It Gives Me Hope  Move That Body

Move That Body