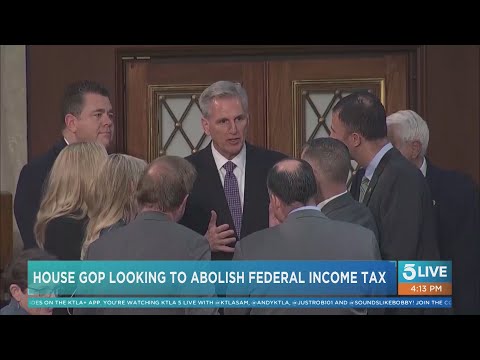

Fair Tax Act Would Replace Income Tax With 30 Percent Sales Tax

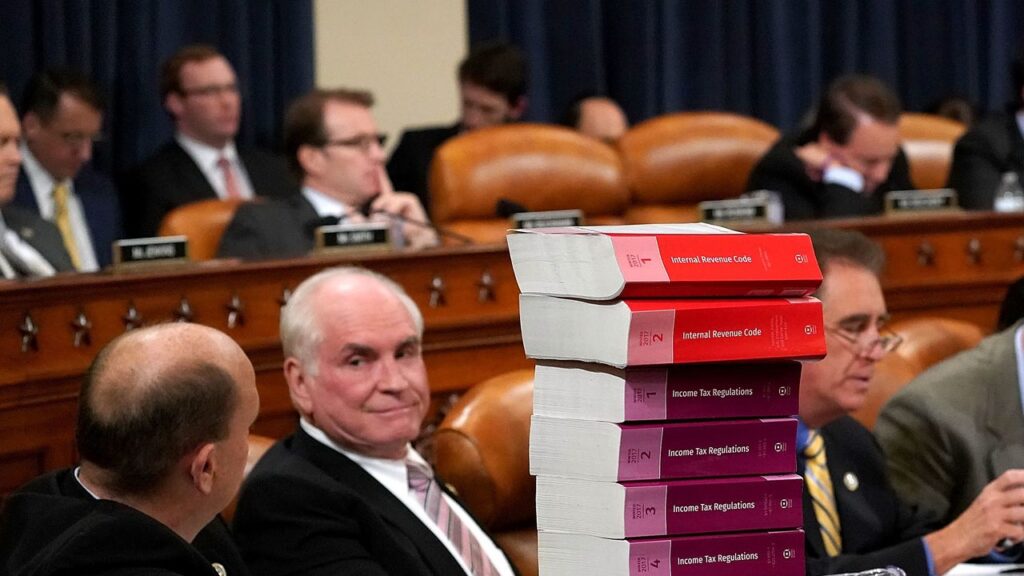

If passed, the Fair Tax Act would replace the current income and payroll taxes with a 30 percent sales tax. The plan was first introduced to Congress in 1999 and subsequently attracted 56 cosponsors.

Supporters of the Fair Tax argue that a national sales tax would boost economic growth in the United States. They also claim that a Fair Tax would eliminate the 17% competitive advantage that foreign producers have over American firms.

Opponents of the plan contend that a sales tax would increase the cost of goods and services and that it would result in a double taxation of saving. They claim that it would be unfair for savers to pay taxes on their savings before they’ve invested them. In addition, they point out that the proposed tax is not revenue neutral.

The Fair Tax Act would also abolish gift and estate taxes. It would also reduce the tax burden on the top 10% of earners. Those in the top ten percent of the income distribution would enjoy a reduction of up to 10 percent in their taxes.

FairTax supporters assert that it would make the tax system more progressive. According to an analysis of the FairTax by economist Laurence Kotlikoff, the average lifetime tax burden for all income levels would be reduced.

Initially, a 23% sales tax would collect $2.6 trillion. As the economy expanded, the revenues to Social Security and Medicare would double.

FairTax supporters believe that a substantial amount of the revenue will come from the black market. Black market activity is largely untaxed under the current tax system.

For more great business content see our business section.

Also, check out our business media partners — USABusinessRadio.com and PriceofBusiness.com.

The Essential Elements of a Successful Business Exit Strategy

The Essential Elements of a Successful Business Exit Strategy  Setting Up Royalties From BMI, ASCAP, MLC, and Top Self Publishing Companies

Setting Up Royalties From BMI, ASCAP, MLC, and Top Self Publishing Companies  The Power of Love in Leadership: How Heart-Centered Leadership Drives Success

The Power of Love in Leadership: How Heart-Centered Leadership Drives Success  7 Strategies To Start Converting More Website Visitors Into Sales

7 Strategies To Start Converting More Website Visitors Into Sales  The Role of Technology and Human Insight in Modern Business Coaching

The Role of Technology and Human Insight in Modern Business Coaching  What Albert Einstein Knew about Your Business Today

What Albert Einstein Knew about Your Business Today  Is There Anything You Can Do To Decrease Your Risk of Alzheimer’s?

Is There Anything You Can Do To Decrease Your Risk of Alzheimer’s?  Microplastics and Opportunity To Grow

Microplastics and Opportunity To Grow  An Open Letter to Senators: A Call To Make America Healthy Hearings

An Open Letter to Senators: A Call To Make America Healthy Hearings  Emotional and Cognitive Triggers of Overeating: A Neuropsychological Perspective

Emotional and Cognitive Triggers of Overeating: A Neuropsychological Perspective